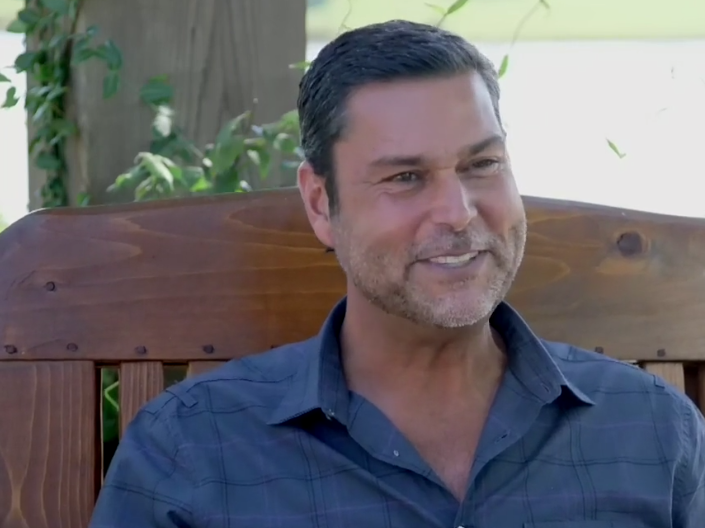

- Real Vision CEO Raoul Pal said crypto's correlation with stocks shifts, but is likely to tighten as the Fed hikes rates.

- He said crypto's correlation to stocks is decoupled when growth is fine and central bank policy is loose.

- "Everything is a risk curve, every single part of the investable universe, and crypto is part of that risk curve," he said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Cryptocurrencies haven't been able to catch a break so far in 2022, despite the booming interest in the metaverse and the "gold rush" in the non-fungible token market, as the stock market has buckled in the face of higher interest rates.

Real Vision chief executive Raoul Pal believes stocks and crypto are set to move in even closer lock-step, particularly as the Federal Reserve brings two years of cheap cash and ultra-loose monetary policy to an end. But this will likely mean even more volatility.

"Everything is a risk curve, every single part of the investable universe, and crypto is part of that risk curve. Sometimes it's correlated, sometimes it's not. When you go to a macro shift, everything gets a correlation of 1, and we've seen that. So it periodically correlates and periodically decouples depending where we're on the risk curve," Pal told the ARK Invest Big Ideas Summit earlier this week.

US blue-chip stocks have been on a near-unbroken downtrend so far in January, with the S&P 500 down around 9%, while the tech-heavy Nasdaq 100 has fared far worse, with a decline of 13%. Bitcoin and other cryptocurrencies have followed suit.

Bitcoin has lost about a fifth of its value so far in January, to trade around $35,000 – a far cry from November's record near $69,000, while 2021's erstwhile superstars like solana and avalanche have lost around 40%.

Crypto's proponents have often cited its role as a portfolio diversifier. But, as interest rates rise and investors have more assets that will offer a decent yield, this relationship will break down, Pal said.

"It tends to be really decoupled in that mid-cycle phase where growth is okay, central bank policy is loose, crypto does its own thing," he said.

It's the shift in the cycle that will alter the correlation, and market volatility is nothing more than a reflection of a shift in the narrative, he said.

"The narrative was the inflation shift. Inflation destroyed marginal spending and marginal investing. And I think we've seen it in meme stocks, we've seen it across the market, we've seen it in cryptocurrencies," he said.

With consumer inflation running at its hottest since 1982 and growth booming along at a four-decade high in the fourth quarter, the Fed has had to shift gears and go from trying to pump up the economy to trying to stop it overheating.

After the Fed's most recent policy meeting on Wednesday, markets are preparing for at least five rate hikes this year. But Pal is less hawkish.

"Central banks will be more dovish than people expect going forwards, so we should have a longer cycle with more tailwinds," he said.

Despite the growth in the later stages of 2021, the economy does not have traction and it may be a few years before the full impact of the coronavirus-driven recession is obvious. Typically, after a recession, growth bounces back quickly, but can then plateau, which can unnerve investors, but rarely means another full recession.

"That's very typical of every recession I've ever followed," he said.